40 gift card for employees taxable

HS207 Non taxable payments or benefits for employees (2019) If you earn at a rate of less than £8,500 a year and you’re not a director, a gift to mark a personal occasion, such as a wedding present, which is not a reward of your employment, is not taxable. Are Gift Cards Taxable to Employees? - Eide Bailly Are Gift Cards Taxable? Gift cards given to employees count as taxable income and must be reported on Form W-2. However, people often incorrectly assume that IRS rules on gift cards to employees are also covered under de minimis fringe benefit rules. What Are De Minimis Fringe Benefits?

Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable Wages - SHRM Thus, when an employer gives an employee a gift, it is taxable under Section 102(c) unless another exception applies. ... a gift card or gift certificate that can only be redeemed for a specific ...

Gift card for employees taxable

FAQ: Are Gift Cards for Employees a Tax Deduction? - Level 6 Incentives The Internal Revenue Service (IRS) tells employers that all cash gifts, including gift cards, are considered taxable wages unless specifically excluded by a section of the Internal Revenue Code (IRC)." This change allowed the IRS to streamline much of small business accounting, reducing overhead for themselves and companies. What About Awards? Are Employee Gifts Taxable? Everything You Need To Know Gift certificates, gift cards and cash equivalent benefits are never tax-exempt This is something the IRS is very clear about. Even if they are given out as holiday or birthday presents from an employer to an employee, these types of gifts are never considered de minimis fringe benefits, and are thus liable to taxation. Publication 463 (2021), Travel, Gift, and Car Expenses ... They paid $80 for each gift basket, or $240 total. Three of Local Company's executives took the gift baskets home for their families' use. Bob and Jan have no independent business relationship with any of the executives' other family members. They can deduct a total of $75 ($25 limit × 3) for the gift baskets.

Gift card for employees taxable. PDF New IRS Advice on Taxability of Gift Cards Treatment of ... - IRS tax forms and any unused portion is forfeited). However, Federal tax law does not view giving an employee a turkey or a ham as the equivalent of giving an employee a gift card to purchase a turkey or a ham. A recently issued Tax Advice Memorandum (TAM) in 2004 clarifies the tax law and discusses this issue. Are Gift Cards taxable For Employees - Blackhawk On Demand • For gifts that can be used like money, like gift cards, companies can deduct up to $25 per person. This means that if you give each employee a $25 gift card for the holidays, you can subtract that from your adjusted gross income. Anything beyond that needs to be reported. Are gift cards taxed? Publication 946 (2021), How To Depreciate Property Section 179 deduction dollar limits. For tax years beginning in 2021, the maximum section 179 expense deduction is $1,050,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,620,000.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021 is $26,200. What Employee Gifts Are Taxable? - Gift Me Your Time Are employee gift cards taxable? There is a tax on gift cards. The IRS considers gift cards for employees to be cash equivalents. You have to include gift cards in an employee's income even if it's not much. See also 10 Best Gifts For 32 Year Old Are Christmas gifts to employees taxable?

Are gift cards taxable employee benefits? | PeopleKeep Yes, gift cards are taxable when offered to employees. The IRS considers it as cash-equivalent, meaning you must report the card's value on an employee's Form W-2 just like a wage. This is the same as taxable fringe benefits such as employee stipends, which must also be reported as wages on employees' W-2s. Understanding the Taxability of Employee Non-Cash Awards and Gifts The Federal Tax Cuts and Jobs Act (P.L. 115-97) signed into law on December 22, 2017 changed the taxability of some non-cash awards and other gifts provided to employees. If an award or gift (or portion of an award or gift) is taxable, applicable income tax withholding and FICA taxes will be deducted from the employee's paycheck.. Beginning on April 1, 2018, departments are responsible for ... What Employers Should Know about Giving Gifts to Employees Employer-provided cash or cash equivalent items are taxable. Per the IRS, a gift card is considered a cash equivalent unless it "allows an employee to receive a specific item of personal property that is minimal in value, provided infrequently, and is administratively impractical to account for." [2] Employee Achievement Awards Gifts to Employees - Taxable Income or Nontaxable Gift? The tax-free value is limited to $1,600 for all awards to one employee in a year. Gifts awarded for length of service or safety achievement are not taxable, so long as they are not cash, gift certificates or points redeemable for merchandise. Gifts to Customers Many companies also give gifts to highly valued customers during this time of year.

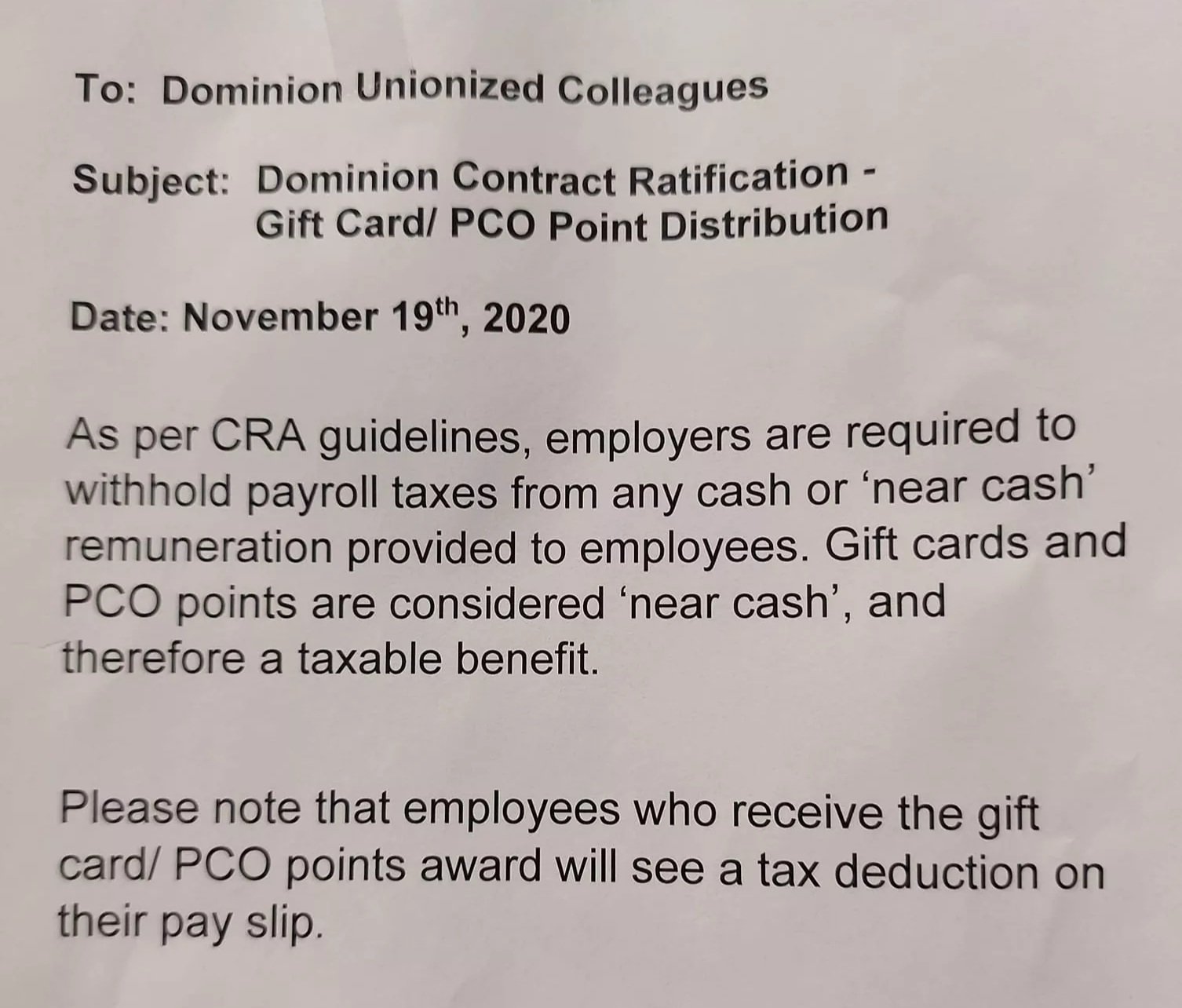

IRS Issues Guidance on Treatment of Gift Cards - The Tax Adviser Rev. Proc. 2011-17. Rev. Proc. 2001-17 establishes a safe-harbor method of accounting for the treatment of gift cards issued to customers in exchange for returned merchandise. The revenue procedure states that—to avoid disputes about the proper characterization of gift cards issued for returned goods, provide better matching of income and ... How The Taxability Of Employee Gifts Works - ILFC A gift card may be tax-deductible as salary expense. The Canada Revenue Agency has specific guidelines for non-cash gifts to employees. If the fair market value of these gifts is less than $500 per year, the gifts are exempt. However, if the value is more than $500 per year, you must pay income tax on the amount above the threshold. De Minimis Fringe Benefits | Internal Revenue Service - IRS tax forms Cash or cash equivalent items provided by the employer are never excludable from income. An exception applies for occasional meal money or transportation fare to allow an employee to work beyond normal hours. Gift certificates that are redeemable for general merchandise or have a cash equivalent value are not de minimis benefits and are taxable. Can I give my employee a gift card without being taxed? There used to be a threshold of $25 to be the maximum amount that could be gifted before having to be taxed, but that is no longer the case. A gift card or cash equivalent is now taxable, regardless of the amount. No matter the amount, a gift card given to employees is not considered a de minimis fringe benefit.

Can An Employer Give A Gift Card To An Employee? However, gift cards may become a logistical headache for employers, and employees may be irritated by a tax surprise. If you insist on giving gift cards, make sure your workers are aware of the tax implications. According to Jason Fell of Entrepreneur Magazine, the Internal Revenue Service taxes gift cards, even if they are just $5.

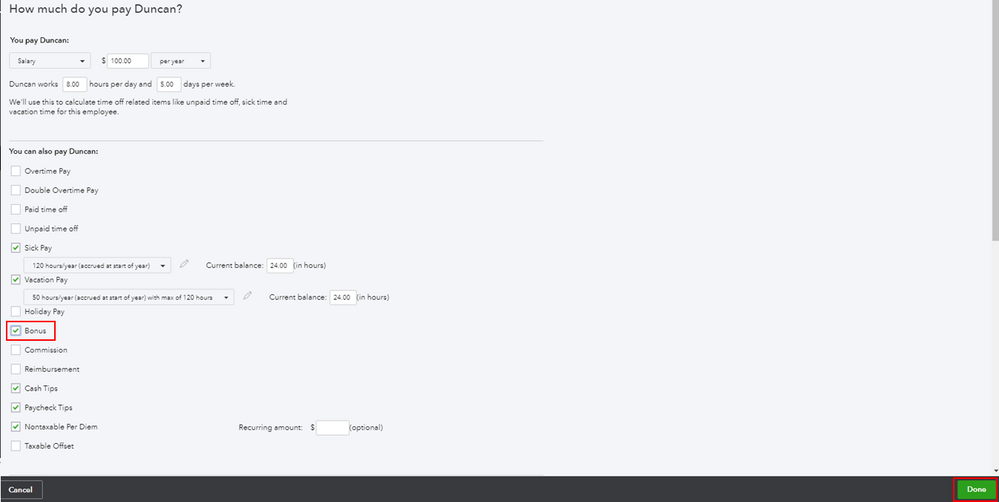

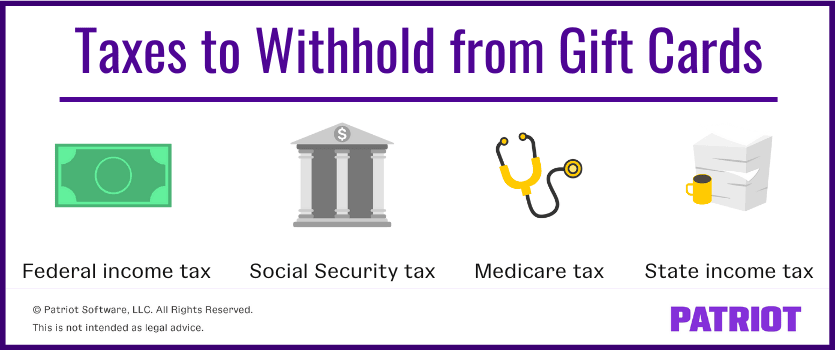

Are gift cards taxable income? | Taxation, fringe benefits & more While many infrequent employee gifts are deemed a de minimis fringe benefit and nontaxable, gift cards are considered supplemental income and should be included in an employee's income and thus, is taxable income. As such, the amount of the card is subject to Social Security tax and Medicare tax as well. The rationale behind this makes sense ...

Are Gift Cards Taxable? IRS Rules Explained Are gift cards taxable? Yes, gift cards are taxable. In the eyes of the IRS, giving your employees a gift card with a cash value is like giving them a bonus. The same goes for...

Know the tax rules for gifts to employees and customers - Beliveau Law So if you give an employee a $10 Starbucks gift card as a thank-you for working late, the $10 is considered taxable. Stock options are also taxable, and can be subject to complex rules. It's a good idea to explain these rules to employees who may be receiving options for the first time, since it's possible for employees to make big mistakes ...

Are Gift Cards Taxable? | Taxation, Examples, & More - Patriot Software Yes, gift cards are taxable. According to the IRS, gift cards for employees are considered cash-equivalent items. Like cash, include gift cards in an employee's taxable income—regardless of how little the gift card value is. But, there is an exception.

Is a gift card or voucher from an employer to an employee taxable in ... Answer (1 of 5): As per income tax act 1961 if any gift recevied by a person in a employee-emloyer's relationship Then there may be two cases * If market price or fair market value of such gift is ₹5000 or less than ₹5000 in total then such whole amount of gift will be exempt in the hands of t...

Are Gifts for Your Team and Clients Tax Deductible in the U.S.? The cost of the gift card is fully deductible to the business, but you must withhold taxes from the employee's pay for these gifts. Team Gift Type 3: Awards. You can deduct up to $400 of the cost of employee safety and service awards of tangible personal property (such as a watch) for each employee for each year.

Publication 525 (2021), Taxable and Nontaxable Income Most payments received by U.S. Government civilian employees for working abroad are taxable. However, certain cost-of-living allowances are tax free. Pub. 516 explains the tax treatment of allowances, differentials, and other special pay you receive for employment abroad.

Tax Rules of Employee Gifts and Company Parties - FindLaw As a general rule, an employer can't really give you a "gift" under the tax code. With only a couple of exceptions, the IRS considers anything your employer gives you to be taxable compensation for your services. Why? There's a simple reason for it.

Ask the Expert: Are All Gift Cards Taxable Income? - HR Daily Advisor However, section (c) (1) of this law provides that employee gifts (including prizes and awards) - specifically "any amount transferred by or for an employer to, or for the benefit of, an employee" - may not be excluded from gross income. So the general rule is that employee gifts and prizes are counted as income.

Business Procedures Manual | 5.3 Employee Pay | University ... Taxable fringe benefits for employees will be reported as taxable wages on IRS Form W-2. Most taxable fringes are subject to federal and state income tax withholding, as well as Social Security and Medicare taxes. Taxable fringes for non-employees are not subject to tax withholding, but may be reportable on IRS Form 1099-MISC.

Are Small Gifts To Employees Taxable? - LegalProX According to the IRS, your gifts to employees are deductible as business expenses and can be as high as $25 per recipient per year. It is possible to deduct gifts like a holiday ham. What gifts are taxable? If you give up to $15,000 to someone in a year, you don't have to worry about the IRS. This will increase to $16,000 in the years to come.

Publication 15-B (2022), Employer's Tax Guide to Fringe ... Moving expense reimbursements. P.L. 115-97, Tax Cuts and Jobs Act, suspends the exclusion for qualified moving expense reimbursements from your employee's income for tax years beginning after 2017 and before 2026. However, the exclusion is still available in the case of a member of the U.S. Armed Forces on active duty who moves because of a permane

Are Employee Gift Cards Considered Taxable Benefits? - Strategic HR According to the IRS, cash, gift certificates, and gift cards are considered taxable fringe benefits and must be reported as wages. But you may be relieved to know that this rule doesn't apply to all gifts or perks that you may give to employees. The IRS tells us that we can exclude the value of a "de minimis" benefit from an employee's wages.

Must-Know Tax Rules for Employee Gift Cards: 2022 Update - Giftogram In fact, any gift card you award to a customer or prospect is non-taxable, whether it's a just-because gift, a customer incentive, a loyalty reward, or a prize won through a promotional contest. Tax Rules for Gift Cards to Employees Gift cards to employees are always taxable, but following the rules doesn't have to be time-consuming or complicated.

Publication 15-A (2022), Employer's Supplemental Tax Guide For social security and Medicare tax purposes, taxable sick pay was $8,400 ($2,000 per month × 70% = $1,400 taxable portion per payment; $1,400 × 6 months = $8,400 total taxable sick pay). Only the six $2,000 checks received by Dave from January through June are included in the calculation.

Are gift cards taxable? | Kroger Gift Cards Yes, gift cards are taxable when received when given to an employee from an employer. Employees will have to claim any funds received on gift cards from their employer in their tax return. Employers will also have to pay tax on any gift cards they give to employees. The IRS will expect tax to be paid on gift cards, even in values as low as $5.

Publication 463 (2021), Travel, Gift, and Car Expenses ... They paid $80 for each gift basket, or $240 total. Three of Local Company's executives took the gift baskets home for their families' use. Bob and Jan have no independent business relationship with any of the executives' other family members. They can deduct a total of $75 ($25 limit × 3) for the gift baskets.

Are Employee Gifts Taxable? Everything You Need To Know Gift certificates, gift cards and cash equivalent benefits are never tax-exempt This is something the IRS is very clear about. Even if they are given out as holiday or birthday presents from an employer to an employee, these types of gifts are never considered de minimis fringe benefits, and are thus liable to taxation.

FAQ: Are Gift Cards for Employees a Tax Deduction? - Level 6 Incentives The Internal Revenue Service (IRS) tells employers that all cash gifts, including gift cards, are considered taxable wages unless specifically excluded by a section of the Internal Revenue Code (IRC)." This change allowed the IRS to streamline much of small business accounting, reducing overhead for themselves and companies. What About Awards?

0 Response to "40 gift card for employees taxable"

Post a Comment